Want To Know About Community-Led And Managed Cryptos And How They Stand Out? Read Here

The entire theme of crypto digital currencies is about decentralisation and community. But did you know that there are certain specific crypto projects with no CEO, no central authority, and no director to manage them; instead, the community manages them. These are called Decentralised Autonomous Organisations (DAOs). Cryptos like Tron (TRX), Uniswap (UNI), Aave (AAVE) and others fall in this category.

Related stories

NASA Will Create Martian Metaverse; Luna Foundation To Repay UST Customers

Crypto Market Continues Recovery; Solana Up 12%; Sebi Concerned On Celebrity Crypto Ads: Report

Terra (LUNA) Wipes Off Billions Of Investor Wealth; Indian Crypto Exchanges Stop Its Trading

"In the world of Blockchain and crypto currency, decentralisation is a prominent theme. The question is what is decentralisation, and to what extent? If a project is launched by an organisation, or a centralised team of founders, it may still, at the protocol level strive to become decentralised," said Ajeet Khurana, founder of Reflexical, a venture capitalist company with focus on web 3.0.

So what are DAOs? And how do these community-driven and managed DAOs function? Read below to find out.

What Are Community-Driven And Managed Cryptos?

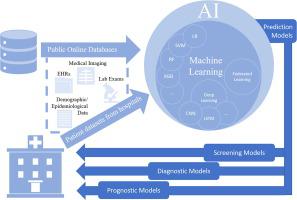

Community-driven and managed crypto projects, or DAOs, have no central authority, single person or entity managing them. Rather, a DAO is an Internet native company, wherein it is collectively owned and managed by its members using smart Blockchain contracts.

"DAOs are part of a movement called 'Government by algorithm', also known as Algocracy. In simpler words, it's like building a democratic system built by algorithms and codes. It's like making the Parliament of a state with the blocks of Smart contracts. And all ministers are like token holders. DAO functions like a democratic system, but unlike ministers who do not reap profits from the law or policy, the DAO shareholders could make a profit once the invested project value gets increased over time," said Dileep Seinberg

Founder & CEO, MuffinPay, a crypto fintech company.

We have new Delegates in the Maker Governance!

Welcome!

- London Business School Blockchain Society @lbsblockchain

- Blockchain@Columbia from Columbia University @BlockchainatCU

- Governance House

12/

As DAOs are community-driven and managed crypto Blockchain companies, they involve the community at all levels, from the initial level of the Blockchain network creation, to the level of crypto coin distribution, and to the level of making decisions and development in the DAO.

How Do They Function?

The management decisions in a DAO are made via proposals that the members vote on, and these decisions are governed by a community organised around a computer-defined set of rules. These computer-defined sets of rules are enforced on the DAO’s Blockchain, and are, hence, called smart Blockchain contracts.

Decisions made by the community include how the DAO company will use its funding and resources, and how the DAO treasury can only be accessed with the approval of its members.

"All DAOs follow a voting mechanism where all the token holders decide how to use the treasury funds of the project," added Seinberg.

What Sets DAOs Apart From Other Centralised Crypto Projects?

Pure Decentralisation: The main aim of every DAO is that the community will decide every aspect of it. Hence, decentralisation is a key focus area for DAOs.

"DAOs take the concept of decentralisationone step further, and makes the organisation itself decentralised. Since it is driven by a computer programme once it is launched it cannot be stopped, so the organisation becomes autonomous," added Khurana.

Independent Decisions: The DAOs have more independent functionality, as the Blockchain smart contracts manage them. The management decisions get made from the bottom-up, are governed by a community, and organised around a specific set of rules enforced on a Blockchain. So, a far greater autonomous feature applies to DAOs than other centralised crypto projects.

Responsibility: The DAOs aim to promote further responsibility, since the community taking the management decisions has to invest their own money into the DAO. So, all the decisions will directly impact their wealth invested in the respective DAO.

"Unlike any other Crypto/blockchain project, which primarily works like Privately owned companies or publicly listed companies where ownership and decision-making power goes to the Board of Directors or major Token holders. DAOs work differently. For example, Dash can be seen as a big DAO project which has a governance mechanism that allows its stakeholders to vote on the use of its treasury. This function of usage of Treasury cannot be done on Bitcoin Ethereum, Luna or any non-DAO project," added Seinberg.

Some Criticisms Against DAO

Like every other crypto project, DAOs also come with some associated risks. Read below to understand them before investing in a DAO.

On June 17, 2017, the original DAO built by some members of the Ethereum (ETH) community, Genesis DAO, was hacked, and approximately 3.6 million ETH coins were stolen. So, before you invest, you should try to understand the security protocols enabled by the respective DAO, and whether they are sufficient or not.

Most DAOs have clearly laid out goals and guidelines. That said, if during the course of its operation, if sufficient members vote, then it may deviate from it. For instance, the Shiba Inu DAO clearly laid out its future plans and others. So, before investing in it, you should understand its goals, and if you think there might be a future in it, then invest your money.

The Shiba Inu DAO goals also include a metaverse plan. Click here to read more about it.

What Did The US SEC Say About DAOs?

The US Securities and Exchange Commission said in a report from 2017 that “tokens offered and sold by a virtual organisation known as the DAO were securities, and therefore, subject to the federal securities laws”.

“The report confirms that issuers of the distributed ledger or Blockchain technology-based securities must register offers and sales of such securities unless a valid exemption applies. Those participating in unregistered offerings may also be liable for violations of the securities laws,” the report said.