Marotta Asset Management Buys General Dynamics Corp, iShares iBoxx USD Investment Grade

Investment company Marotta Asset Management (Current Portfolio) buys General Dynamics Corp, iShares iBoxx USD Investment Grade Corporate Bond , Caterpillar Inc, Pfizer Inc, Deere, sells Generac Holdings Inc, Moderna Inc, Global X FTSE Nordic Region ETF during the 3-months ended 2021Q4, according to the most recent filings of the investment company, Marotta Asset Management. As of 2021Q4, Marotta Asset Management owns 113 stocks with a total value of $441 million. These are the details of the buys and sells.

For the details of Marotta Asset Management's stock buys and sells,go to https://www.gurufocus.com/guru/marotta+asset+management/current-portfolio/portfolio

These are the top 5 holdings of Marotta Asset Management

Vanguard Information Technology ETF (VGT) - 72,268 shares, 7.50% of the total portfolio. Shares reduced by 3.65%

Vanguard Mid-Cap Value ETF (VOE) - 206,722 shares, 7.04% of the total portfolio. Shares added by 1.07%

Vanguard FTSE Emerging Markets ETF (VWO) - 604,751 shares, 6.78% of the total portfolio. Shares added by 6.95%

Vanguard Total International Bond ETF (BNDX) - 489,741 shares, 6.12% of the total portfolio. Shares added by 6.26%

Vanguard Short-Term Inflation-Protected Securities (VTIP) - 519,999 shares, 6.06% of the total portfolio. Shares added by 7.72%

New Purchase: General Dynamics Corp (GD)

Marotta Asset Management initiated holding in General Dynamics Corp. The purchase prices were between $188.97 and $209.52, with an estimated average price of $201.98. The stock is now traded at around $211.610000. The impact to a portfolio due to this purchase was 0.24%. The holding were 5,077 shares as of 2021-12-31.

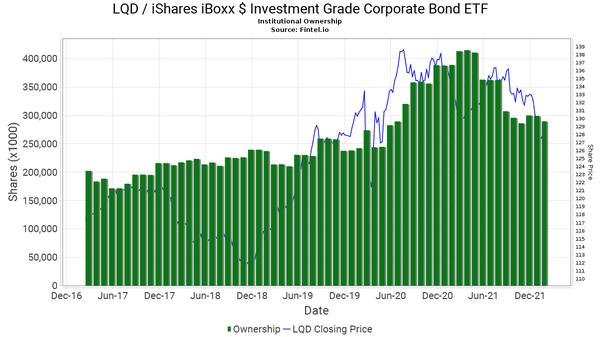

New Purchase: iShares iBoxx USD Investment Grade Corporate Bond (LQD)

Marotta Asset Management initiated holding in iShares iBoxx USD Investment Grade Corporate Bond . The purchase prices were between $130.49 and $134.38, with an estimated average price of $132.44. The stock is now traded at around $129.845000. The impact to a portfolio due to this purchase was 0.09%. The holding were 3,123 shares as of 2021-12-31.

New Purchase: Deere & Co (DE)

Marotta Asset Management initiated holding in Deere & Co. The purchase prices were between $329 and $367.86, with an estimated average price of $348.32. The stock is now traded at around $379.950000. The impact to a portfolio due to this purchase was 0.06%. The holding were 832 shares as of 2021-12-31.

New Purchase: Caterpillar Inc (CAT)

Marotta Asset Management initiated holding in Caterpillar Inc. The purchase prices were between $188.94 and $214.25, with an estimated average price of $201.63. The stock is now traded at around $225.570000. The impact to a portfolio due to this purchase was 0.06%. The holding were 1,381 shares as of 2021-12-31.

New Purchase: Pfizer Inc (PFE)

Marotta Asset Management initiated holding in Pfizer Inc. The purchase prices were between $41.32 and $61.25, with an estimated average price of $49.81. The stock is now traded at around $55.640000. The impact to a portfolio due to this purchase was 0.06%. The holding were 4,647 shares as of 2021-12-31.

New Purchase: Global X MSCI Norway ETF (NORW)

Marotta Asset Management initiated holding in Global X MSCI Norway ETF. The purchase prices were between $28.76 and $33.28, with an estimated average price of $31.09. The stock is now traded at around $31.457100. The impact to a portfolio due to this purchase was 0.05%. The holding were 7,184 shares as of 2021-12-31.

Added: Amazon.com Inc (AMZN)

Marotta Asset Management added to a holding in Amazon.com Inc by 32.48%. The purchase prices were between $3189.78 and $3696.06, with an estimated average price of $3427.48. The stock is now traded at around $3247.180000. The impact to a portfolio due to this purchase was 0.03%. The holding were 155 shares as of 2021-12-31.

Added: Norfolk Southern Corp (NSC)

Marotta Asset Management added to a holding in Norfolk Southern Corp by 47.71%. The purchase prices were between $247.88 and $297.71, with an estimated average price of $279.86. The stock is now traded at around $289.615000. The impact to a portfolio due to this purchase was 0.03%. The holding were 1,548 shares as of 2021-12-31.

Added: Coeur Mining Inc (CDE)

Marotta Asset Management added to a holding in Coeur Mining Inc by 64.29%. The purchase prices were between $4.78 and $7.19, with an estimated average price of $5.99. The stock is now traded at around $5.280000. The impact to a portfolio due to this purchase was 0.01%. The holding were 23,000 shares as of 2021-12-31.

Added: Intellia Therapeutics Inc (NTLA)

Marotta Asset Management added to a holding in Intellia Therapeutics Inc by 33.33%. The purchase prices were between $100.76 and $138.36, with an estimated average price of $125.01. The stock is now traded at around $93.010000. The impact to a portfolio due to this purchase was 0.01%. The holding were 2,000 shares as of 2021-12-31.

Sold Out: Generac Holdings Inc (GNRC)

Marotta Asset Management sold out a holding in Generac Holdings Inc. The sale prices were between $341.3 and $505.8, with an estimated average price of $414.31.

Sold Out: Moderna Inc (MRNA)

Marotta Asset Management sold out a holding in Moderna Inc. The sale prices were between $225.82 and $368.51, with an estimated average price of $290.69.

Sold Out: Global X FTSE Nordic Region ETF (GXF)

Marotta Asset Management sold out a holding in Global X FTSE Nordic Region ETF. The sale prices were between $30.72 and $33.28, with an estimated average price of $32.05.

Here is the complete portfolio of Marotta Asset Management. Also check out:1. Marotta Asset Management's Undervalued Stocks2. Marotta Asset Management's Top Growth Companies, and3. Marotta Asset Management's High Yield stocks4. Stocks that Marotta Asset Management keeps buyingThis article first appeared on GuruFocus.