FIATA Focuses on Unfair Shipping Competition, Digital Trade Documents

[Stay on top of transportation news: Get TTNews in your inbox.]

New digitized trade documents and unfair competition from shipping lines infringing on turf for inland cargo are top priorities during a gathering of transportation leaders and government officials convened by the world’s largest freight forwarding association.

The International Federation of Freight Forwarders Associations (FIATA), founded in 1926, started its May 17-20 Geneva 2022 HQ Meeting Reconnect with a hybrid press conference sponsored by the Geneva Press Club.

Finally able to meet after two years due to the pandemic, Geneva-based FIATA created an event for the first time to include the news media and public with 40,000 freight forwarding and logistics member companies due to widespread interest in supply chain issues, noted Pierre Ruetschi, press club director.

At #FIATA, we strive to help and support our members everyday. #freightforwarding #logistics #supplychain #cargo #multimodal #transport pic.twitter.com/72UQaQDORs

— FIATA (@fiatafederation) January 21, 2021Stéphane Graber, FIATA director general, described the organization as the voice of the global logistics industry and present in 150 countries. Reflecting its international focus, FIATA’s presidency team executives are from Bulgaria, South Africa, Turkey, Singapore, Belgium, Ecuador, the United Kingdom and Switzerland.

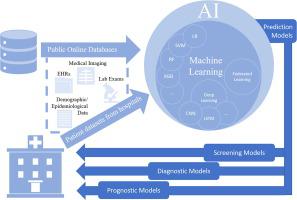

“We provide tools to our members, transport documents and forms, and we have a very ambitious digitalization strategy for trade documents,” Graber noted. “The role of the freight forwarder is really to coordinate and support this supply chain, to facilitate and optimize and offer the best possible logistics for the customers and for the shippers.”

International Federation of Freight Forwarders Associations

FIATA unveiled its digital bill of lading system using blockchain technology to authenticate documents and provide an audit trail to ensure greater security than paper documents. Software providers agreeing to implement it are: Akanea, Cargowise, CargoX, Nabu, edoxOnline (Global Share), InfoSysTech-IST and Usyncro.

FIATA President Ivan Petrov identified digitalization, multimodality, sustainability and supply chains issues as key areas. FIATA focuses on multimodal cargo and auxiliary services such as arranging documents, warehousing, stock control, customs and first- to last-mile delivery.

“We are digital freight forwarders,” Petrov declared, noting that COVID-19 necessitated creating an online payment platform for FIATA members. New digital multimodal trade documents will improve supply chain problems.

International Federation of Freight Forwarders Associations

Avoiding politics about the war in Ukraine, he said the situation has created serious logistical challenges for cargo and resulted in searches for new transportation corridors to avoid Russia and deal with Ukraine as a landlocked nation without sea access. This has forced cargo to move in alternative paths using Asia and southeastern Europe.

RoadSigns · RS84: How Are Fleets Considering Insurance Coverage?Host Michael Freeze discusses insurance coverage and costs with Jane Jazrawy of Carriers Edge and David Berno of Hub International. Tune in above or by going to RoadSigns.TTNews.com.

Petrov said an important topic impacting FIATA is vertical integration of the ocean freight carriers. “They have entered into niche markets — which were absolutely before part of the freight forwarding and logistics industries — since they are not concentrating any more on port-to-port services, but also on last-mile solutions,” he said.

Senior Vice President Jens Roemer acknowledged that while competition generally is good, shipping lines have an unfair competitive edge since they are protected through alliances and have tax advantages that freight forwarders lack.

“There are today 10 shipping lines controlling 90% of the main world trade,” Roemer said. “Our conclusion is that shipping lines support their own services.”

He said FIATA has investigated member complaints about shipping carriers pressuring companies to use their inland services instead. He added that some companies may be unable to book a container from port-to-port unless they “add a customs service or tracking service, then you may get the booking.”

Calling the unfair practices global, Petrov said, “If you don’t buy it [shipping services] through to the end, you cannot successfully have merchant haulage or obtain containers for this transport.”

Want more news? Listen to today's daily briefing above or go here for more info

In February, the European Association for Forwarding, Transport, Logistics and Customs Services wrote a letter urging the European Commission to investigate profiteering for ocean shipping resulting from their capacity management strategy that enables them to acquire “the market power and financial war chest that they are now using to vertically integrate, increase rates and drive out independent freight forwarders in the downstream market.”

It noted that European businesses continue to experience rising container shipping costs, with “massive” freight rate hikes over the past 18 months that had led to inflation.

According to FIATA, shipping carriers also set up port rules that damage freight forwarding business, including demurrage and detention fees, and inland container pick-up/drop-off charges as they expand inland services.